4 ways to reorder checks

Although digital banking is the most prevalently used method these days, many consumers still place their trust in checks. However, banks issue checks in the starter kit that you get while opening an account and it comes with a limited number of leaflets. If you use checks frequently, then you would need a lot of checks other than just one checkbook. Following are the four ways that you can consider when you need to reorder checks.

Reorder checks through online banking

In most cases, your bank will give you a login account and a password. If it does not come in your starter kit, then you may ask for it through online banking or by visiting the nearest branch.

Request your agent for re-issuance of checks through telephone banking

All the banks come with a phone banking facility for its consumers. You would need to keep your transit/routing number as well as account details handy. The phone banking executive may ask you to verify your details, after which you may place a request to reorder checks. Usually, upon such a request, you will receive a fresh checkbook within 7 to 10 business days.

Visit the bank branch to reorder checks

If online banking and phone banking are both problematic for you, then you may reorder checks by visiting the nearest branch as well. The customer service agent will take you through the process, and your checkbook will get delivered within 7 to 10 business days.

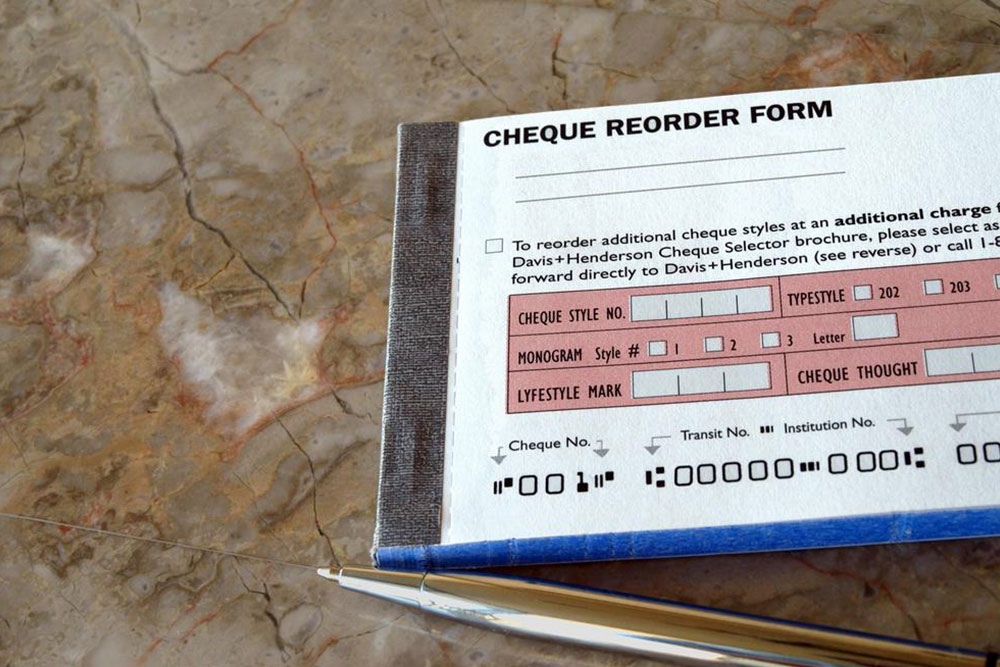

Reorder through a vendor

Online vendors verified by Check Payments Systems Association (CPSA) offer great deals to you for printing your checks and reissuing them as well. One trusted name for the aforementioned service is Harland Clarke’s printing, but there are several other vendors as well who offer similar services.

You may track the delivery of your check through the request number issued to you. Another important trick to remember is that you would need to place a request for reordering a check when you have last few checks remaining in your previous leaflet. Now, with the right information, make sure you never run out of checks.